Cover Art: Commonwealth CEO Dawson Rutter and Director of Operations and Affiliate Relations Tami Saccoccio stand among Rutter’s vast car collection. Photography by Andrew Schneps of Back Bay Photography.

The Boston company’s CEO and Director of Operations and Affiliate Relations share their accrued wisdom, which isn’t necessarily COMMON but could steer your company toward a lot of WEALTH.

Cover Art: Commonwealth CEO Dawson Rutter and Director of Operations and Affiliate Relations Tami Saccoccio stand among Rutter’s vast car collection. Photography by Andrew Schneps of Back Bay Photography.

The Boston company’s CEO and Director of Operations and Affiliate Relations share their accrued wisdom, which isn’t necessarily COMMON but could steer your company toward a lot of WEALTH.

Dawson Rutter is living his best life. After more than 35 years in the industry, he has found his ideal balance, and achieved what most entrepreneurs and business owners aspire for in their lifetime: A successful company that does not rely on his daily involvement to continue to grow and thrive.

Like many other well-known figures in our industry, Rutter started humbly with just one car. He worked the long hours and put in the sweat equity. Client by client and vehicle by vehicle, Commonwealth flourished to become a multimillion-dollar enterprise with offices in both Boston (its headquarters) and New York City, which is led by his brother, Scott. Slowly and steadily, he’s been able to devote more time to the next phase of his personal and professional life, which includes a lot more travel to his second home in Arizona; hobbies like golf, woodworking, and collecting both wine and vehicles; and spending time with his family and friends.

Founder and CEO Dawson Rutter with part of his vehicle collection

But he always has a finger on the pulse of his company, even if he’s no longer there on a regular basis. Back at the office, the team is led by his well-known and well-respected Director of Operations and Affiliate Relations Tami Saccoccio, who has her own impressive contributions to flaunt. She joined the company in May 2004 as a call center manager and affiliate director at a time when Commonwealth was in an aggressive growth phase, but lacked an organized affiliate network. Saccoccio built the network from the ground up into what is now one of the largest in the country, and continues to expand its worldwide presence. Last year, Commonwealth had traveling clients in 87 countries.

Founder and CEO Dawson Rutter with part of his vehicle collection

But he always has a finger on the pulse of his company, even if he’s no longer there on a regular basis. Back at the office, the team is led by his well-known and well-respected Director of Operations and Affiliate Relations Tami Saccoccio, who has her own impressive contributions to flaunt. She joined the company in May 2004 as a call center manager and affiliate director at a time when Commonwealth was in an aggressive growth phase, but lacked an organized affiliate network. Saccoccio built the network from the ground up into what is now one of the largest in the country, and continues to expand its worldwide presence. Last year, Commonwealth had traveling clients in 87 countries.

Rutter and Saccoccio are more than just professional colleagues: The couple recently became engaged last year.

As an industry icon, Rutter’s peers often seek his advice, which he generously shares as a speaker at events, through association involvement, and as a mentor at the Chauffeur Driven Show. Rutter and Saccoccio offered their sage advice for how you too can reach your best life and most profitable company yet.

Good financial management is a must.

Above all else, any company needs to have a solid financial rudder steering the ship, whether it’s using an outside consultant, an in-house CFO, or a combination of the two. Of course that includes an array of duties from shoring up the books to brazen moves like eliminating clients who could be costing you money, as CFOs can help identify areas of weakness and loss within the business.

“You have to know what’s happening within your company. CFOs do the financial reports but they are also down-to-earth people who know how to run businesses and very often will transition to the CEO position,” says Rutter, who counts various CFOs among his most important business mentors over the years.

Rutter and Director of Operations and Affiliate Relations Tami Saccoccio overlooking the Boston Skyline

Salespeople are the key to growing your business.

Rutter and Director of Operations and Affiliate Relations Tami Saccoccio overlooking the Boston Skyline

Salespeople are the key to growing your business. Rutter, like most small business owners, spent a lot of time doing the myriad duties it takes to make a company tick, often getting caught up in the minutiae of the day-to-day operations while leading sales. In 1998, after 16 years in business and with 22 cars in operation, he made a calculated decision to build a bigger and better company—which meant he needed help.

“A good sales department is a great way to grow your business. Most entrepreneurs handle sales and run the business themselves, but there’s only so far you can get while doing both,” he says. “You really need to go out and find qualified salespeople—which is a very difficult thing to do—but you have to do it despite the difficulty. Salespeople are an investment in your company and you have to compensate them well. You take a risk, you dive in, and it either works or doesn’t—you can’t think of it as a waste. We’ve burned through a lot salespeople who washed out after six months or a year, but we still have a core sales team that’s between 8 and 10 people at any given time. Some are stronger than others, but they all contribute. We’re constantly adding to our team.”

While “qualified” is subjective according to the business and its objectives, Rutter says that he’s found that candidates who have played sports in college or high school tend to be successful salesmen.

Ultimately, his plan worked. Between 1998 and 2007, the company grew at an average rate of 45 percent per year and is now the largest it’s ever been.

“Uncommon” wisdom on TNCs

“I think Uber is great for our business because it’s educating and exposing millions of people to what is essentially a taxi service, and once they’ve gotten used to the experience and want a higher level of chauffeured transportation, they will use our services,” he says. Before founding Commonwealth, Rutter drove a taxicab for a decade, working for a cab company owned by the father of Boston Car Service’s Brett Barenholtz. Because of his experience, he made “consistency” and “commitment” the hallmarks of his company’s service so there were no surprises.

“I don’t worry about TNCs at all. I think our market will increase dramatically over the next 10-20 years mainly because of disgruntled Uber and taxi customers. A small percentage of the population will ever use chauffeured transportation, but even if it’s only 1 or 2 percent of the millions who are riding with Uber now would still be great for us, and they will be.”

Trust your people. “I think Uber is great for our business because it’s educating and exposing millions of people to what is essentially a taxi service, and once they’ve gotten used to the experience and want a higher level of chauffeured transportation, they will use our services,” he says. Before founding Commonwealth, Rutter drove a taxicab for a decade, working for a cab company owned by the father of Boston Car Service’s Brett Barenholtz. Because of his experience, he made “consistency” and “commitment” the hallmarks of his company’s service so there were no surprises.

“I don’t worry about TNCs at all. I think our market will increase dramatically over the next 10-20 years mainly because of disgruntled Uber and taxi customers. A small percentage of the population will ever use chauffeured transportation, but even if it’s only 1 or 2 percent of the millions who are riding with Uber now would still be great for us, and they will be.”

Isn’t the chief goal of any business owner to enjoy the fruits of their labor after years of building a company that no longer relies on them? It’s hard for anyone to delegate when they have a vision for their own business and think only they can accomplish it best. Rutter says that as he hired people, they had to wrest those responsibilities away from him—and he often fought them all the way—until he realized how liberating it was to let go.

“A lot of people in this industry have a great deal of difficulty delegating responsibility to their team. Until you can do that, you are really just stifling the growth of your business,” he says. “Every entrepreneur thinks that they can do the job better than anyone else, so they never let anyone else take on those responsibilities—but you will never grow if you have that mentality. Delegate, give your managers the latitude to be creative and do things their own way, don’t micromanage, and never override their decisions.”

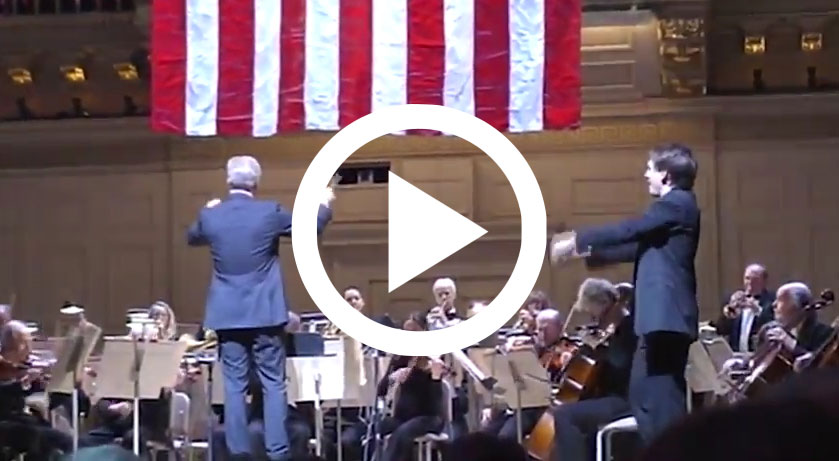

A true Renaissance Man: Dawson Rutter shows off his impressive skills as a guest conductor of the Boston Pops Orchestra during a 2007 performance of John Philip Sousa’s Stars and Stripes Forever.

Saccoccio and other senior-level managers now handle what was once part of Rutter’s daily juggling act, while stepping away from the business empowered his managers and supervisors in the process. Saccoccio is also a frequent traveler—often with Rutter—but she can trust that her team will execute the everyday functions without requiring that she physically be there to see that they do. Of course, both are always just a phone call away.

A true Renaissance Man: Dawson Rutter shows off his impressive skills as a guest conductor of the Boston Pops Orchestra during a 2007 performance of John Philip Sousa’s Stars and Stripes Forever.

Saccoccio and other senior-level managers now handle what was once part of Rutter’s daily juggling act, while stepping away from the business empowered his managers and supervisors in the process. Saccoccio is also a frequent traveler—often with Rutter—but she can trust that her team will execute the everyday functions without requiring that she physically be there to see that they do. Of course, both are always just a phone call away.

Rutter’s role has evolved so that he’s more of a guide for his team rather than the decision-maker. “If people come to me about a problem, I will help them find a path to the solution but will stop short of solving it for them,” he says. “You have to let your managers make bad decisions because over time they’ll make better ones and grow to be autonomous in their role. If you override or micromanage what your supervisors are doing, they will lose all credibility and confidence, and will never make another decision on their own again.”

Hire the right people for the right stage of business.

Business growth isn’t without its share of pain, especially when it comes to your human assets. And just like salespeople, your employees are an investment. Oftentimes, growth can be overwhelming for staff who aren’t flexible or resist those challenges that push them out of their comfort zone. “We found that as we grew, some people who were very effective when we were smaller weren’t as effective when we were bigger. We had to bring in some staff who understood the level we were at and be able to work within that framework,” he says.

Tami’s Take: Dos and Don’ts With Affiliates

Saccoccio has seen and heard it all, and while she says that she is blessed with a solid network of affiliate companies, it too is an ongoing process of re-evaluating and strengthening. “When you have to fire an affiliate, it’s not easy to try and find someone else immediately,” she says. “It’s a long process now to ensure that they are operating on the same level as our company, have the same technological capabilities—that’s where we have to compete with Uber, so it’s tough finding affiliates who match or are willing to implement that technology.”

DO communicate all the time. “This is my number one DO,” she says. “Things go wrong, but if I hear first from the affiliate with a solution instead of from an angry customer, I think that’s a sign of a great partner. We can get to the client and diffuse the situation before they are calling us.” She adds: “We have a fantastic relationship with companies like Windy City and Park Avenue. They are in touch with me constantly via email, phone, or text. All of our partners are really wonderful.”

DON’T be rude to companies that are giving you lots of work. “I had an incident recently where the affiliate was calling our staff and just berating them. I listened in on a few of the phone calls and was just horrified. Too many affiliate companies act like doing this work is doing the affiliate a favor—but it’s not. We’re in this together: We want to see you grow and we want to help you grow.”

DON’T make outrageous demands. “I had an affiliate who increased their rates by 50 percent practically overnight, with no room for negotiation. I had never seen rates like this—ever—and we were giving them seven figures worth of business a year. We had to scramble to find other affiliates but we had no choice but to part ways. It worked out in the end because we found the best partner in the long run to replace them.”

DON’T ignore calls about incidents. “If an affiliate refuses to discuss or return phone calls about an incident that happened while handling a client, it usually severs the relationship instantly.”

DON’T lie. What more can we say?

Saccoccio has seen and heard it all, and while she says that she is blessed with a solid network of affiliate companies, it too is an ongoing process of re-evaluating and strengthening. “When you have to fire an affiliate, it’s not easy to try and find someone else immediately,” she says. “It’s a long process now to ensure that they are operating on the same level as our company, have the same technological capabilities—that’s where we have to compete with Uber, so it’s tough finding affiliates who match or are willing to implement that technology.”

DO communicate all the time. “This is my number one DO,” she says. “Things go wrong, but if I hear first from the affiliate with a solution instead of from an angry customer, I think that’s a sign of a great partner. We can get to the client and diffuse the situation before they are calling us.” She adds: “We have a fantastic relationship with companies like Windy City and Park Avenue. They are in touch with me constantly via email, phone, or text. All of our partners are really wonderful.”

DON’T be rude to companies that are giving you lots of work. “I had an incident recently where the affiliate was calling our staff and just berating them. I listened in on a few of the phone calls and was just horrified. Too many affiliate companies act like doing this work is doing the affiliate a favor—but it’s not. We’re in this together: We want to see you grow and we want to help you grow.”

DON’T make outrageous demands. “I had an affiliate who increased their rates by 50 percent practically overnight, with no room for negotiation. I had never seen rates like this—ever—and we were giving them seven figures worth of business a year. We had to scramble to find other affiliates but we had no choice but to part ways. It worked out in the end because we found the best partner in the long run to replace them.”

DON’T ignore calls about incidents. “If an affiliate refuses to discuss or return phone calls about an incident that happened while handling a client, it usually severs the relationship instantly.”

DON’T lie. What more can we say?

Saccoccio at the Boston headquarters

The cycle continues, even as Commonwealth is at its biggest with 85 cars in Boston and 105 cars in New York City. “We’ve had that at every stage of growing the business: People get to the point where they can’t go any further and become disgruntled because their job isn’t like it used to be, so you bring in new people. It’s a constant flow of managing and evaluating and replacing as needed. All of this takes a lot of time. You go through people who you think are going to be a good fit but aren’t. We are always hiring.”

Many business gurus will refer to the 80/20 rule, a term that has been applied to everything from sales to time management to marketing. The Pareto Principle, as it’s called, can be boiled down to this: 80 percent of the results will come from 20 percent of the action.

Saccoccio at the Boston headquarters

The cycle continues, even as Commonwealth is at its biggest with 85 cars in Boston and 105 cars in New York City. “We’ve had that at every stage of growing the business: People get to the point where they can’t go any further and become disgruntled because their job isn’t like it used to be, so you bring in new people. It’s a constant flow of managing and evaluating and replacing as needed. All of this takes a lot of time. You go through people who you think are going to be a good fit but aren’t. We are always hiring.”

Many business gurus will refer to the 80/20 rule, a term that has been applied to everything from sales to time management to marketing. The Pareto Principle, as it’s called, can be boiled down to this: 80 percent of the results will come from 20 percent of the action.

When it comes to staffing, Rutter follows a similar maxim called the 90/10 rule: Ten percent of your workforce is causing 90 percent of the problems. By consistently monitoring those who aren’t performing as well, they eliminate them before they can infect the rest of the team and impact morale. Commonwealth also works with a consultant who assists with identifying those folks and helps to replace them.

Don’t be afraid to use consultants.

Smart business owners know to surround themselves with people who aren’t afraid to challenge a concept and with those who have the knowledge in key operating areas (e.g., HR and marketing). That experience and expertise, however, comes at a premium. The best consultants in the business are generally the most expensive, so Rutter found a clever solution: Hire them for one or two days a week instead of full time.

“They may only be in the office for one eight-hour day, but they are thinking about your business all week long and coming to the table with a bunch of good ideas. I’ve worked with consultants for years, and it’s an incredible investment.”

Commonwealth also has a dedicated board of advisors that includes Rutter, the company’s CFO, Scott Rutter, and an attorney who specializes in mergers and acquisitions.

The couple also enjoy collecting—and sampling—wine

Bonus: Build solid relationships.

The couple also enjoy collecting—and sampling—wine

Bonus: Build solid relationships. There are moments that take your breath away, even in the face of tragedy. Last November, Rutter and Saccoccio experienced the loss of Rutter’s son, DA, who passed suddenly at 23. While their grief was expected, what surprised them was the outpouring of love and support from all facets of the industry. Hundreds of people posted messages of hope and faith on social media, but that was only the most visible form of support.

“Some people literally dropped everything and flew in from California, Vancouver, Toronto—all over the continent—and stayed the week with us. I think every affiliate city was represented. And it helped tremendously to have everyone around us. I know we wouldn’t have gotten through it without everyone around us that first week,” Saccoccio says.

Rutter says that the church service was packed beyond capacity—standing room only—with loved ones that included so many industry friends. “It turned a terrible, horrible day into a beautiful one. It made us value those relationships even more, and we just feel much closer to all of them and appreciate how much they did for us.” [CD0718]