Change is hard and scary. It’s difficult to pivot when faced with uncertainty and business interruption, especially when it’s beyond your control and you can’t get a handle on what’s coming next. The stress and fear can be debilitating for any business owner. But as a leader, it’s crucial to figure out what is best for you, and what is best for the business. It’s great when these two things are aligned, but often they are at odds. It is challenging to plan the future when it feels like it’s based what-ifs and gut feelings. The good news is, many owners have some time now that things are slower. Whether the plan is to exit soon, or in the next 10+ years, business owners need to stay focused on building their biggest asset—their company.

Now is the time for exit planning, whether it’s in the immediate future or 20 years down the road.

Now is the time for exit planning, whether it’s in the immediate future or 20 years down the road.

You should be building an exit plan on your terms. I know it sounds crazy: We’re in the middle of a pandemic, an economic crisis, businesses are shut down, and customers aren’t traveling like they used to. Running a small business isn’t easy, especially at a time when a lot of owners are thinking about closing their doors. What would happen if you shut down your business tomorrow? Most owners work harder than they have to, earn less than they should, and leave a lot on the table when they exit. Worse, most are not thinking about their exit planning until it’s too late to make any real and lasting improvements. Use the time you have now to create a plan.

Understand the plan vs. reality when it comes to exit planning.

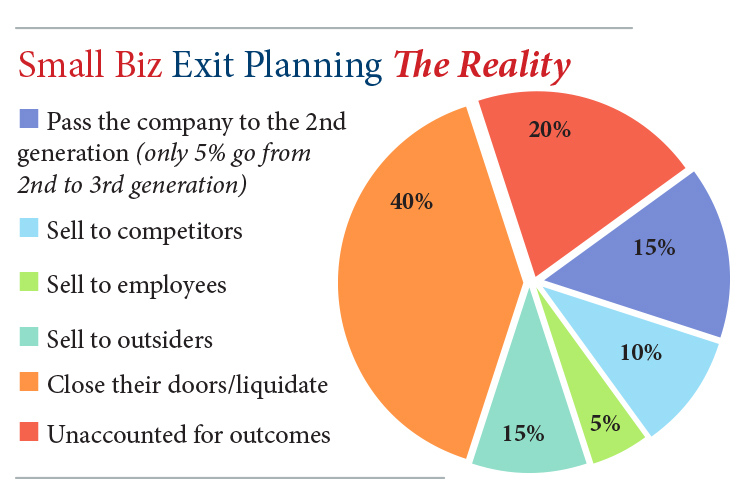

Generally, 50 percent of small business owners plan to pass it on to family members when they’re ready to exit, 10 percent of owners plan to sell to a competitor, 30 percent plan to sell to employees, and 10 percent plan to sell to outsiders. More often than not, these ideas are more like dreams and they never make it onto paper to put into action (the chart shows what actually happens). And the reality is, owners without an exit plan are more likely to watch their businesses get sold for pennies on the dollar than to see it transition to the next generation.

Build an exit plan.

What we hear most from business owners is that their exit plan is “leaving in a pine box.” However, exit planning doesn’t have to be complicated or stressful; however, it does require dedication from the owner—and sometimes the management team—to set up properly. You have invested in this business, so why are you willing to leave the exit up to chance? There’s enough left to chance or circumstance without this being another on that list. Only 2 percent of owners know the value of their own businesses—their largest asset when it comes to exit planning. After years of spending time, money, and effort to improve the value of your home (if you own one), would you ever leave your house keys on the kitchen counter, unlock all the doors, and let some stranger occupy it? Absolutely not. So why are you doing that with your business?

The first step is to get a valuation for your business.

The first step is to get a valuation for your business.

It’s the elephant in the room that no one wants to talk about: What if my businesses isn’t worth what I think it is? What if all this sweat equity I have put in over the years doesn’t add up to real measurable value? It can be scary to think about that, but this isn’t the time to avoid the monster in the closet—this is the time to tackle it head on. Being an entrepreneur means taking on the challenges that no one else will and building solutions. You can do this. Having this information will allow you to chart your path.

To plan and understand where the company can go, take an accurate assessment of where things currently stand.

Now is not the time to defend prior actions or mistakes. This is the time to take inventory of the past, and make the conscious decision to do better, put plans in place, and follow through. This is where you can reimagine your business and set goals to ensure a profitable future. Dig into your P&L and understand your balance sheet. Talk to your team about their observations on how the operation is functioning. Use historical data to build a forecast for the future and how your business is trending. Make adjustments before it’s too late to affect change. There’s enough uncertainty so it will be crucial to know what you’re working with in order to set goals for the next one, three, and five years, and ultimately build your exit plan.

Avoid FOMO: Making rash decisions to chase revenue may not result in long-term benefits.

Often business owners get stuck in this pattern of FOMO—fear of missing out. They want to chase the dollars or the next great thing. Sometimes this means that the business gets put at risk because there’s blind excitement behind dashing for revenue. Building a sustainable business with long-term customers will help contribute to the overall value of your company. When it comes to exit planning, potential buyers want to see that the operation can sustain that book of clients, and the want to see steady rising revenue and profits. Proper exit planning can ensure that you as the owner have the best possible outcome with a business that funds your exit or retirement. Small business is about building sustainable and profitable machines that contribute to the local economy, and ultimately to the national economy. Privately held businesses employ millions of people: they feed families, they support each other, they build communities. You are building a legacy, and your exit planning should reflect that. [CD0820]

Robyn Goldenberg is Director of Operations and Marketing for Strategy Leaders. She can be reached at robyn@strategyleaders.com.