BY MATT DAUS

NOTE: FinCEN issued the following update on 3.26.25: All entities created in the United States — including those previously known as “domestic reporting companies” — and their beneficial owners are now exempt from the requirement to report beneficial ownership information (BOI) to FinCEN. Existing foreign companies that must report their beneficial ownership information have at least an additional 30 days from March 26, 2025—until April 25, 2025, for most companies—to do so. For more information, see press release and alert.

The Corporate Transparency Act (CTA), enacted in 2021 and implemented on January 1, 2024, is aimed at combating financial crimes like money laundering and tax evasion, and requires many previously anonymous entities to disclose their true owners. New York State enacted the New York Limited Liability Company Transparency Act (NYLTA), which has some similarities but also key differences. New York is currently the only state to pass its own additional CTA-like law; however, it is likely that other states will do so in the future.

This legislation provides law enforcement with beneficial ownership information for detecting and punishing terrorism, money laundering, and other misconduct. Currently, the CTA remains enforceable by the Financial Crimes Enforcement Network (FinCEN), a bureau of the US Department of the Treasury. While ground transportation may not be the direct target, the composition of our industry means that most will need to comply or seek an exemption. Compliance applies not only to new entities but also retroactively to those formed many years ago.

This legislation provides law enforcement with beneficial ownership information for detecting and punishing terrorism, money laundering, and other misconduct. Currently, the CTA remains enforceable by the Financial Crimes Enforcement Network (FinCEN), a bureau of the US Department of the Treasury. While ground transportation may not be the direct target, the composition of our industry means that most will need to comply or seek an exemption. Compliance applies not only to new entities but also retroactively to those formed many years ago.

Although the CTA may be tested in the courts—such as with the decision issued by Judge Liles Burke in the Northern District of Alabama declaring the CTA unconstitutional—the legal process remains ongoing. Because of the fragmented nature of our judicial system, we may see a split in the Federal Circuit Courts of Appeals, which can spur a review by the US Supreme Court, but it’s imperative to act now regardless.

While the required paperwork and content of the reporting are not alarming, there are real concerns about NOT doing so on time, which could lead to massive fines and even criminal penalties. It is highly recommended that you do not do this yourself! Contact your attorney, or I can be reached anytime.

WHO MUST FILE & WHAT MUST BE DISCLOSED?

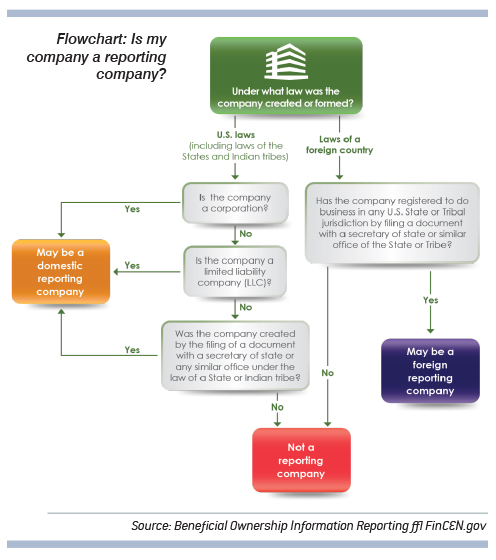

Reporting companies, which includes any corporation, LLC, etc., that is formed/registered in the US through certain state filings, must file reports disclosing:

“Beneficial Owners”: This includes any individual who, directly or indirectly, • owns at least 25% of the company’s equity, or • has “substantial control” over the company; and

“Company Applicants”: This includes the individual who filed the formation documents, and one other individual who primarily directed their filing.

Reporting for “company applicants” is effective only for companies formed in 2024 or later. Required information includes the legal name, date of birth, residential address, and a copy of government-issued ID (e.g., driver’s license or passport). If an individual registers with FinCEN, then the company can instead disclose the individual’s FinCEN ID number, which can be used for future formations and filings without having to provide personally identifying information in each instance.

The CTA does offer a surprising 23 exemptions, which include “large operating companies” (i.e., companies with more than 20 US full-time employees [excluding independent operators and part-time workers], more than $5,000,000 in annual US gross receipts, etc.), certain inactive entities, certain regulated entities (e.g., banks, public utilities, etc.), tax-exempt organizations, and certain subsidiaries of exempt companies. Your attorney can help navigate the exemptions.

CTA REPORTING DEADLINES

Initial filing deadlines:

| Year First Formed/Registered | CTA Report Due Date |

| Calendar year 2023 or earlier | January 1, 2025 |

| Calendar year 2024 | Within 90 days of formation/registration |

| Calendar year 2025 and later | Within 30 days of formation/registration |

Amendments: Due within 30 days of any change in the information in a filed CTA report.

LATE FILING FINES & CRIMINAL PENALTIES

Civil penalties are currently up to $500 per day, per company, and criminal charges can result in a maximum of two years imprisonment plus a $10,000 fine, per company. On the civil side, a multi-level group of companies consisting of four separate entities could be subject to $2,000 per day in penalties. For criminal charges, the non-compliance must be done knowingly with an intent to commit fraud or provide false information to FinCEN, which is a high standard and currently untested. However, inconsistencies between your CTA reporting and state-level filings may lead to an inquiry, so getting this done right is critical.

CTA AND NYLTA COMPARISON

NYLTA is in effect starting December 21, 2024, for LLCs operating in the Empire State. Like the CTA, NYLTA requires disclosure of beneficial ownership information for LLCs formed/registered in New York, uses the same definitions of “beneficial owner” and “substantial control,” and uses the same 23 exemptions.

Key NYLTA differences:

• Reporting starts January 2025 (but may be delayed);

• Applies only to LLCs, not other entities like corporations;

• Requires LLCs to file an “exempt company statement” if claiming an exemption;

• Reports require business address, not residential address, of beneficial owners;

• Must disclose the unique number from an ID document, but not a copy of such ID document;

• No FinCEN ID number concept offered in New York;

• No disclosures required for “company applicants;”

• Updates only needed on changes to articles of organization, not all information changes (an anticipated amendment may change this to an annual update requirement);

• Lower penalties for non-compliance (i.e., no criminal fines); and

• Public access to beneficial owner names and business addresses (an anticipated amendment may change this to government access only).

POTENTIAL COMPLIANCE ISSUES

Non-Cooperation of Business Partners: Both the CTA and NYLTA require companies to disclose their beneficial owners. One common scenario might occur if multiple beneficial owners of a company cannot timely coordinate the submission of information from all individuals, and the entity is now facing the associated penalty of $500 per day for non-compliance, requiring counsel to send notices to the non-complying owner while insulating the complying owners from any liability.

Transportation companies should get ahead of the curve and ensure that compliance mechanisms are in place so that the non-complying parties are held responsible for any fines caused by their inaction. Adjustments can be made to operating and stockholder agreements to provide an enforcement structure (including attorneys’ fees) against recalcitrant beneficial owners.

Transportation companies should get ahead of the curve and ensure that compliance mechanisms are in place so that the non-complying parties are held responsible for any fines caused by their inaction. Adjustments can be made to operating and stockholder agreements to provide an enforcement structure (including attorneys’ fees) against recalcitrant beneficial owners.

Cross-Jurisdiction Compliance & Data Security Issues: Concerns regarding privacy, compliance costs, and data security should be addressed as well. Navigating the intricacies of the laws, particularly for cross-border operations, may require professional guidance involving any international investors. For example, beneficial owners who are living abroad and are only invested in the foreign parent company that wholly owns a domestic reporting company may—for the first time—be subject to American scrutiny and may be reluctant to share personal information.

That personal identifying information may be transmitted electronically through your company’s email server, making it subject to unknown data protection and security laws of foreign (and more stringent) jurisdictions like the European Union, or even California if the owner is a California resident. California compliance will be key because it is likely to follow suit and enact its own transparency law in the future.

Your lawyers can help evaluate data privacy and protection risks and advise on the best course of action to mitigate any of those risks. Depending on your company’s ownership structure, you should consider a total review of your commercial and operating agreements to determine the flow of information and how to best comply with applicable laws and regulations.

WHAT TO DO NEXT

Because filing will be under the lens of FinCEN and/or the New York Department of State, it is important for each reporting company to take the time to do a refresher to ensure compliance with all corporate requirements, and that all the necessary governance items are up-to-date and executed. Work with your legal team to:

❱ Determine the number of full-time US-based employees in each company at the time of reporting;

❱ Calculate the annual gross receipts for each company for the fiscal year of reporting

❱ Confirm the stockholders and members of each company;

❱ For those individuals you will need:

• copies of government issued identification

• full legal name

• date of birth, and

• residential address

❱ Create an organizational chart;

❱ Certify that governance documents are complete, executed, and accurately reflect the current beneficial owners as of the filing date—any changes should be done before reporting if the deadline to report has not lapsed;

❱ Check your state’s Secretary of State’s website to see that your company is up to date on its state level reporting, filings, and statements;

❱ If any of the above changes, then you should revaluate whether your company is obligated to report;

❱ Contact counsel to determine your reporting obligations.

While the intent of this legislation is a significant step towards more transparent and accountable corporate governance and recordkeeping to combat illegal practices, some in the business world see this as an overreach or a revenue grab. It is unlikely to be repealed anytime soon and many states are likely to create their own additional laws like New York just did. As these laws take effect, transportation companies and many other industries must adapt and embrace this new landscape of ownership disclosure. [CD0424]

Matt Daus is a senior partner at Windels Marx Lane and Mittendorf, and founder/chair of the Transportation Practice Group. He can be reached at mdaus@windelsmarx.com.